[ad_1]

Managing an workplace comes with its distinctive challenges, and staying knowledgeable of business developments is important to making sure monetary stability. Whereas every workplace operates in a different way, understanding prevalent developments can provide priceless insights into your apply’s monetary well being.

Right here, we delve into key fee developments affecting workplace managers and supply actionable insights for maximizing profitability.

Navigating Cost Panorama Shifts

In recent times, the panorama of fee processing has undergone vital transformations, pushed by evolving client preferences and technological developments. Amidst these adjustments, it’s essential for workplace managers to remain knowledgeable about how fee developments have impacted their backside line.

Finest Card, the endorsed fee processor of the ADA Member Benefit and 50+ dental and psychological associations has been working with 1000’s of dental places of work nationwide for over 15 years, and we intention to shed some mild on pertinent questions usually ignored by workplace managers:

- Common Credit score Card Funds: How does your workplace’s bank card processing quantity evaluate to business averages?

- Worth Changes: Has your workplace adjusted service charges to offset inflationary pressures?

- Cost Processing Prices: What are you truly paying to course of bank cards on the apply? Be taught to calculate the efficient charge you’re paying, and uncover what is affordable for this, and the way it impacts your backside line.

Understanding these dynamics can empower workplace managers to make knowledgeable choices and optimize monetary efficiency.

How A lot Does the Common Dental Workplace Acquire in Credit score Playing cards?

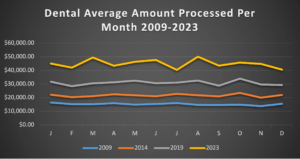

Dental places of work have seen a big improve within the whole quantity of bank card funds collected over the previous 10+ years and Covid accelerated that development significantly, as sufferers moved in the direction of fee strategies that had been extra handy and concerned much less bodily contact. Moreover, many insurance coverage suppliers began issuing digital bank cards as fee for his or her remittances, which additionally elevated the variety of card funds dental practices are accepting.

In 2023, the common dental workplace ran $44,925 in bank card funds per thirty days.

In 2023, the common dental workplace ran $44,925 in bank card funds per thirty days.

-

- That’s a forty five.5% improve over the 2019 common of $30,876.

- It’s a 195% improve over the 2009 common of $15,221. The common apply is now operating virtually 3 occasions as a lot in bank cards as in 2009!

Whereas accepting bank cards ensures that places of work can rapidly and simply accumulate funds, with extra sufferers and insurance coverage suppliers selecting to pay with playing cards, it’s a far more substantial issue within the apply’s backside line than previously.

Have Practices Raised Their Prices to Hold Up with Inflation?

Each workplace supervisor understands that the challenges introduced by Covid, together with disruptions within the provide chain and inflationary pressures, have led to elevated operational prices. Consequently, many places of work throughout numerous industries have discovered it vital to regulate their pricing methods to be able to offset these rising bills.

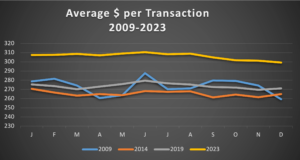

This development is clear when analyzing the common fee dimension throughout completely different practices.

-In 2023, the common bank card fee accepted by dental places of work was $306 in comparison with $273 in 2019 – a rise of 11.87% in simply 4 years.

-From 2009 to 2019, the common fee solely elevated 0.12% over a ten 12 months interval.

-2023 noticed a slight lower within the common fee in comparison with 2022: from $307 to $306, indicating that will increase as a result of inflation could also be slowing.

The Shopper Worth Index exhibits that inflation within the U.S. from 2019 to 2023 was 19.2%, so though the rise in common dental transaction dimension from 2019 onward marked a considerable distinction in comparison with 2009-2019, the 11.87% improve hasn’t saved up with the economy-wide value hike.

What Does the Common Apply Pay to Run Playing cards?

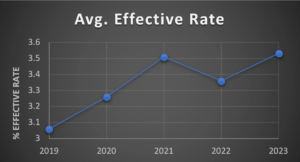

On the similar time that the common dental workplace’s fee quantity has elevated, the prices incurred to run these funds has additionally elevated, and sometimes these charges might be arduous to know. What’s simple to discern, nevertheless, is the affect on the underside line of the apply.

To determine this out, you need to calculate your efficient charge with some basic math on a latest assertion:

Whole Charges Paid ÷ Whole {Dollars} Processed = Your Efficient Charge for the Month

In 2023, the common dental workplace within the U.S. paid 3.53% in comparison with 3.06% in 2019. These charges are already too excessive, however to place it in perspective, again in 2014, the common dental workplace paid 2.84%.

So, the common workplace is paying extra as a proportion whereas additionally accepting 45% extra card funds than they did again earlier than the pandemic. That makes an enormous distinction.

Put in actual numbers:

- The common workplace in 2019 ran $30k at a charge of three.06% for a complete of $944 per thirty days in charges.

- The common workplace in 2023 ran $45k in card funds, and is now paying 3.45%, for a complete of $1,585 per thirty days in charges.

- For the common apply, that’s a rise of $ 7k per 12 months in prices over simply 4 years.

Whereas the common workplace paid 3.53% in 2023, Finest Card’s common dental workplace on the unique charges provided to ADA Members paid 2.22% in 2023 for a mean financial savings of $6,496 per 12 months.

Abstract

As workplace managers, your days are crammed with numerous obligations, making it simple to miss small will increase within the prices of companies you’re utilizing. Typically, these small will increase are frequent sufficient to have an finally huge affect.

Any a part of your enterprise that will increase considerably over time ought to be analyzed periodically to guarantee that it’s assembly the wants of your backside line. For those who see that you simply’re paying extra to just accept bank cards whereas additionally taking extra funds, it could be time to search for a greater choice.

To search out out what Finest Card may have the ability to save your apply, ship us a latest month-to-month assertion and we are able to do a complimentary price evaluation to indicate you precisely what your apply may very well be saving.

About Our Sponsor:

Phil Nieto is the President of Finest Card, the endorsed bank card processor of the ADA Member Benefit. He enjoys working with 1000’s of dental places of work to assist reduce the complications of accepting card funds by specializing in offering what the service provider companies business usually lacks: innovation and integrity. On the uncommon alternatives for a quiet second, he loves spending time together with his spouse and children.

Cited Sources:

1. Creator, U.S. Bureau of Labor Statistics, (December 2019 – December 2023). CPI Inflation Calculator. Retrieved from [U.S. Bureau of Labor Statistics].

2. Creator, Federal Reserve Financial institution of Minneapolis, (1913-Current). Inflation Calculator. Retrieved from [Inflation Calculator, Federal Reserve Bank of Minneapolis].

3. Finest Card (December 2019 – December 2023). Common Efficient Charge Dec. 2019_Dec.2023. Finest Card. Retrieved from [Processing Volume Report 2008-2024].

4. Finest Card (2009 – 2023). Common Cost Quantity Per Transaction 2009-2023. Finest Card. Retrieved from [Processing Volume Report 2008-2024].

5. Finest Card (2009 – 2023). Common Quantity Processed Per Month 2009-2023. Finest Card. Retrieved from [Processing Volume Report 2008-2024].

[ad_2]