[ad_1]

What was as soon as his profitable marketing campaign concern is now a toss-up.

That is an version of The Atlantic Day by day, a publication that guides you thru the largest tales of the day, helps you uncover new concepts, and recommends the most effective in tradition. Join it right here.

Donald Trump has lengthy solid himself as Mr. Financial system. The previous president has claimed on the marketing campaign path that his final time period noticed “the most effective financial system within the historical past of our nation.” (He glosses over the financial disaster of 2020.) He has offered a slate of far-fetched concepts for find out how to carry down the price of residing and strengthen enterprise. (See: “Drill, child, drill”; his guarantees to impose large tariffs; his thought to deport immigrants to open up extra housing; and his suggestion that he himself needs to “have a say” in toggling rates of interest, which he later walked again.)

Till just a few months in the past, voters—who say that the financial system is the largest marketing campaign concern on their minds—seemed to be shopping for his pitch. In polls, Individuals overwhelmingly stated that they trusted him greater than President Joe Biden to deal with the financial system. However a lot has modified in latest months: As soon as Kamala Harris turned her social gathering’s nominee, she shortly distinguished her marketing campaign’s financial message from Biden’s, a technique that has resonated with some voters. Final month, the Federal Reserve lowered rates of interest for the primary time in additional than 4 years, successfully signaling to Individuals that inflation is over—and triggering a stream of constructive information protection to that impact. Voters’ perceptions of the financial system writ massive have proved cussed, however the American public appears increasingly more keen to entertain the concept Harris might be a greater chief than Trump on the problem.

Scarred by a interval of excessive costs and inflation, Individuals have been reluctant to just accept the message—from Biden or from pundits—that the financial system is sweet, really, although inflation cooled off considerably by 2023 and the unemployment charge has been close to historic lows for a lot of the previous three years. (Shopper sentiment has risen significantly since a mid-2022 nadir, however it’s nonetheless nowhere close to pre-pandemic ranges). Harris’s technique thus far has not centered on defending Biden’s document; as an alternative, her marketing campaign has tried to distinguish her from the president—at the same time as Trump has tried to current her as an extension of Biden’s legacy. “Whether or not or not Harris is in the end saddled with Biden’s financial baggage could come all the way down to who wins this narrative battle,” my colleague Rogé Karma, who covers economics, informed me.

Harris has centered on acknowledging the excessive price of residing and providing paths to fight it—a departure from Biden, who spent the previous 12 months making an attempt desperately to persuade voters that the financial system was robust, Rogé stated. Harris’s strategy (which Rogé has known as “Bidenomics with out Biden”) appears to be working thus far: One ballot discovered that she had a one-point lead over Trump on the financial system in September, simply three months after Biden was working 11 factors behind Trump on the problem. Different polls additionally present Trump’s edge because the trusted financial system candidate shrinking. “The financial system as a difficulty has gone from being the profitable concern for Trump to a digital tie,” Rogé defined.

Harris has gained on Trump, however this pattern is just not assured to proceed till November. One major predictor of success for the incumbent social gathering, Gabriel Lenz, a political-science professor at UC Berkeley, informed me, is the expansion of what economists name “actual disposable earnings,” or Individuals’ earnings after taxes and transfers—spending cash, in different phrases. Proper now, that metric is on the fence: “We’re not seeing that incomes are going up relative to inflation as a lot as they might be,” Lenz stated. Information tales also can shift voter notion within the ultimate weeks of an election, even in our calcified political second, Lenz argued. Historic precedent has been set for that: In 1992, for instance, the financial system was selecting up earlier than the election, however the truth that media protection remained adverse could have influenced the incumbent George H. W. Bush’s loss, Lenz prompt. (It didn’t assist that Invoice Clinton’s group did its finest to tie Bush to that adverse narrative: That election featured the notorious Clinton-campaign line “It’s the financial system, silly.”)

The broad realities of the American financial system haven’t meaningfully modified since Harris entered the race, and Individuals don’t out of the blue really feel rosy about it. However the messenger has modified, and that could be sufficient to compel some voters on this ultimate stretch. As a result of many Individuals are thus far distinguishing Harris from the Biden administration’s financial coverage, she has been in a position to benefit from good financial information in a manner that Biden by no means fairly may.

Associated:

Listed below are 4 new tales from The Atlantic:

Right this moment’s Information

- Iran launched waves of ballistic missiles at Israel. The Israeli navy didn’t instantly report any casualties, however a Palestinian man was reportedly killed by shrapnel within the occupied West Financial institution. Iran stated that it had concluded its assault.

- Senator J. D. Vance and Minnesota Governor Tim Walz will face off tonight within the vice-presidential debate hosted by CBS Information, airing at 9 p.m. ET.

- Claudia Sheinbaum, a former mayor of Mexico Metropolis, was sworn in as Mexico’s first feminine and first Jewish president.

Dispatches

Discover all of our newsletters right here.

Night Learn

Hurricane Helene Created a 30-Foot Chasm of Earth on My Avenue

By Chris Moody

We knew one thing had gone terribly unsuitable when the culverts washed up in our yard like an apocalyptic artwork set up splattered with free rock and black concrete. The round metallic tubes have been an important piece of submerged infrastructure that after channeled water beneath our road, the first connection to city for our small rural group simply exterior Boone, North Carolina. After they failed beneath a deluge created by Hurricane Helene, the slender strip of concrete above didn’t stand an opportunity. Encumbered by a fallen tree, the street crashed into the river, making a 30-foot chasm of earth close to our home.

Extra From The Atlantic

Tradition Break

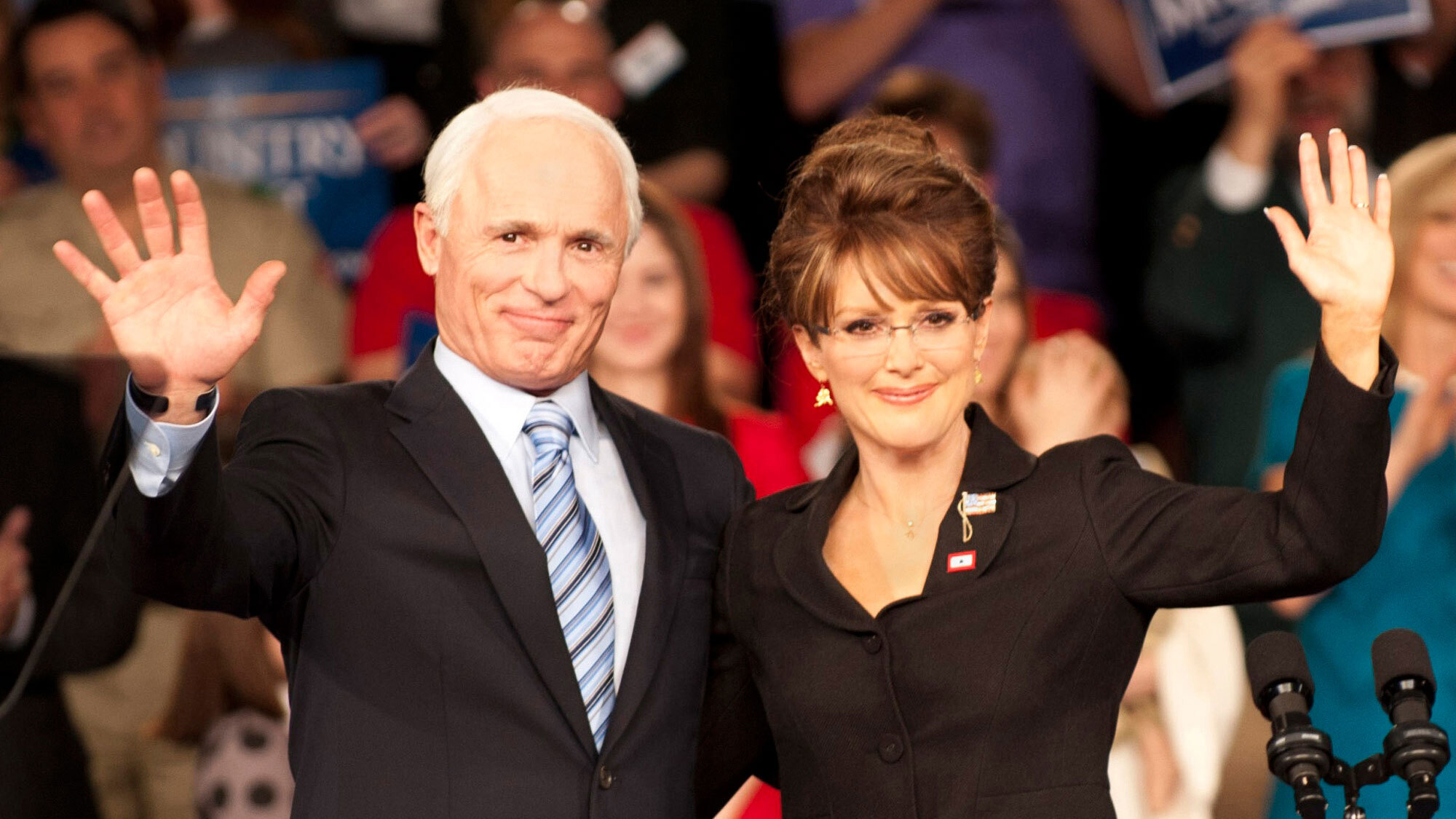

Rewatch. The 2012 movie Sport Change (streaming on Max) knew precisely what was coming for American politics, James Parker writes.

Debate. Malcolm Gladwell’s insistence on ignoring the online in his new e-book, Revenge of the Tipping Level, is an even larger blind spot in the present day than it was when The Tipping Level got here out, Gal Beckerman argues.

Stephanie Bai contributed to this text.

Whenever you purchase a e-book utilizing a hyperlink on this publication, we obtain a fee. Thanks for supporting The Atlantic.

[ad_2]